New York State Medicaid Update - March 2018 Volume 34 - Number 3

In this issue …

- All Providers

- Policy and Billing Guidance

- Pharmacy Update

National Healthcare Decisions Day 2018

National Healthcare Decisions Day (NHDD) is April 16, 2018. This nationwide annual initiative is dedicated to sharing information about advanced care planning and encouraging people to start the advanced care planning process with their loved ones. It was created to "inspire, educate, and empower the public and providers about the importance of advance care planning". For more information, visit: www.nhdd.org.

Advanced care planning is the process of communicating and documenting your wishes for medical treatment in the event that you are no longer able to speak for yourself. Through the advanced care planning process you may fill out advanced directives or appoint a health care proxy to document your wishes. According to a national survey, ninety percent of people say that talking to their loved ones about end-of-life care is important, yet only twenty-seven percent have done so (The Conversation Project National Survey, 2013).

NHDD in New York is a day to help people understand that advanced care planning includes much more than filling out forms; it is a process focused first on conversations about your wishes with your loved ones. Everyone has a role to play; families talking with each other about their care preferences and wishes as well as physicians helping patients to understand how to make sure their wishes are followed in a clinical setting.

Here are some simple steps you can take to start your advanced care planning process:

- Think about what matters to you. It can be helpful to prepare yourself before talking to others about advanced care planning. Think about what matters most to you and what you value.

- Start the conversation. Make time to talk with your loved ones, doctors, or other healthcare professionals about what matters to you and what type of medical treatment you would like if you were unable to speak for yourself. It may take one conversation or it may take many, but starting the conversation about your wishes is often the hardest part.

- Fill out the forms. New York State advanced directives include a Healthcare Proxy, Living Will, and Medical Orders for Life Sustaining Treatment (MOLST).

- Review and revise. Advanced care planning is a process. You can always update your advanced directives if your preferences have changed. Review the decisions you made periodically and discuss them with your healthcare proxy and doctors to make sure everyone still understands your wishes.

For more information on how you can participate in National Healthcare Decisions Day or for more information on advanced care planning, visit these resources:

- New York State Department of Health: https://www.health.ny.gov/professionals/patients/patient_rights/.

- National Healthcare Decisions Day: https://www.nhdd.org/.

- Compassion and Support: http://www.compassionandsupport.org/.

New Dental Director and Dental Policy Mailbox

Michele Griguts, DDS is the new Dental Director in the Bureau of Medical, Dental, and Pharmacy Policy within the Department of Health's Office of Health Insurance Programs. The Bureau's dental team will focus on policies that strengthen the oral health of Medicaid members, especially children, and ensure access to dental services. Questions about Medicaid dental policy and associated questions regarding clinic billing can be directed to the new dental policy mailbox at dentalpolicy@health.ny.gov.

Provider Training Schedule and Registration

Do you have billing questions? Are you new to Medicaid billing? Would you like to learn more about ePACES?

If you answered "yes" to any of these questions, consider registering for a Medicaid training session. eMedNY offers various types of educational opportunities to providers and their staff. Training sessions are available at no cost to providers and include information for claim submission, Medicaid Eligibility Verification, and the eMedNY website.

Seminars

Seminars are a valuable opportunity to meet personally with CSRA's eMedNY Regional Representatives in your area. Seminars are in-person training sessions with groups of providers and billing staff conducted at locations throughout NYS. For seminars offered at a location near you, please check the eMedNY website at: http://www.emedny.org/training/index.aspx.

Webinar Training Also Available

You may also register for a webinar. Webinar training sessions will be conducted online and you will be able to join the meeting from your computer and telephone. After registration is completed, you will receive an email with instructions to join the online meeting and then just log in at the announced time. No travel involved.

Many sessions offer detailed instruction about Medicaid's free web-based program ePACES, the electronic provider assisted claim entry system that allows enrolled providers to submit the following types of transactions:

- Claims

- Eligibility Verifications

- Claim Status Requests

- Prior Approval/DVS Requests

Fast and easy registration, locations and dates are available on eMedNY website at: http://www.emedny.org/training/index.aspx. The website is updated quarterly with new sessions. eMedNY Regional Representatives look forward to having you join them at upcoming training sessions. If you are unable to access the internet to register or have questions about registration, please contact the eMedNY Call Center at (800) 343–9000.

2018 Spousal Impoverishment Income and Resource Levels Increase

Attention providers of nursing facility services, certain home and community based waiver services and services to individuals enrolled in a managed long term care plan.

Providers of nursing facility services, home and community based waiver services and services to individuals enrolled in a managed long term care plan are required to print and distribute the "Information Notice to Couples with an Institutionalized Spouse" at the time they begin to provide services to their patients.

Effective January 1, 2018, the federal maximum community spouse resource allowance increases to $123,600 while the community spouse income allowance increases to $3,090. The maximum family member monthly allowance increases to $686.

This information should be provided to any institutionalized spouse, community spouse or representative acting on their behalf to avoid unnecessary depletion of the amount of assets a couple can retain under the spousal impoverishment eligibility provisions.

| Date | Allowance |

|---|---|

| January 1, 2018 | Federal Maximum Community Spouse Resource Allowance: $123,600 Note: A higher amount may be established by court order or fair hearing to generate income to raise the community spouse's monthly income up to the maximum allowance. Note: The State Minimum Community Spouse Resource Allowance is $74,820. |

| January 1, 2018 | Community Spouse Minimum Monthly Maintenance Needs Allowance is an amount up to: $3,090.00 (if the community spouse has no income of his/her own) Note: A higher amount may be established by court order or fair hearing due to exceptional circumstances that result in significant financial distress. |

| January 1, 2018 | Family Member Monthly Allowance for each family member is an amount up to: $686 (if the family member has no income of his/her own). |

Note: If the institutionalized spouse is receiving Medicaid, any change in income of the institutionalized spouse, the community spouse, and/or the family member may affect the community spouse income allowance and/or the family member allowance. Therefore, the social services district should be promptly notified of any income variations.

Information Notice to Couples with an Institutionalized Spouse

- "Information Notice to Couples with an Institutionalized Spouse" is available as a PDF.

- Additionally, the form Request for Assessment should be printed and distributed.

Medicaid is an assistance program that may help pay for the costs of your or your spouse's institutional care, home and community based waiver services, or enrollment in a managed long term care plan. The institutionalized spouse is considered medically needy if his/her resources are at or below a certain level and the monthly income after certain deductions is less than the cost of care in the facility.

Federal and State laws require that spousal impoverishment rules be used to determine an institutionalized spouse's eligibility for Medicaid. These rules protect some of the income and resources of the couple for the community spouse.

Note: Spousal impoverishment rules do not apply to an institutionalized spouse who is eligible under the Modified Adjusted Gross Income (MAGI) rules.

If you or your spouse are:

- In a medical institution or nursing facility and are likely to remain there for at least 30 consecutive days; or

- Receiving home and community based services provided pursuant to a waiver under section 1915(c) of the federal Social Security Act and are likely to receive such services for at least 30 consecutive days; or

- Receiving institutional or non-institutional services and are enrolled in a managed long term care plan; and

- Married to a spouse who does not meet any of the criteria set forth under (1) through (3), these income and resource eligibility rules for an institutionalized spouse may apply to you or your spouse.

If you wish to discuss these eligibility provisions, please contact your local department of social services. Even if you have no intention of pursuing a Medicaid application, you are urged to contact your local department of social services to request an assessment of the total value of your and your spouse's combined countable resources. It is to the advantage of the community spouse to request such an assessment to make certain that allowable resources are not depleted by you for your spouse's cost of care. To request such an assessment, please contact your local department of social services or mail the attached completed "Request for Assessment Form." New York City residents should contact the Human Resources Administration (HRA) Medicaid Helpline at (888) 692–6116.

Information about resources:

Effective January 1, 1996, the community spouse is allowed to keep resources in an amount equal to the greater of the following amounts:

- $74,820 (the State minimum spousal resource standard); or

- The amount of the spousal share up to the maximum amount permitted under federal law ($123,600 for 2018).

For purposes of this calculation, "spousal share" is the amount equal to one-half of the total value of the countable resources of you and your spouse at the beginning of the most recent continuous period of institutionalization of the institutionalized spouse. The most recent continuous period of institutionalization is defined as the most recent period you or your spouse met the criteria listed in items 1 through 4 (under "If you or your spouse are:"). In determining the total value of the countable resources, we will not count the value of your home, household items, personal property, your car, or certain funds established for burial expenses.

The community spouse may be able to obtain additional amounts of resources to generate income when the otherwise available income of the community spouse, together with the income allowance from the institutionalized spouse, is less than the maximum community spouse monthly income allowance, by requesting a fair hearing or commencing a family court proceeding against the institutionalized spouse. Your attorney or local Office for the Aging can provide you with more information.

Either spouse or a representative acting on their behalf may request an assessment of the couple's countable resources, at the beginning, or any time after the beginning of a continuous period of institutionalization. Upon receipt of such request and all relevant documentation, the local district will assess and document the total value of the couple's countable resources and provide each spouse with a copy of the assessment and the documentation upon which it is based. If the request is not filed with a Medicaid application, the local department of social services may charge up to $25.00 for the cost of preparing and copying the assessment and documentation.

Information about income:

You may request an assessment/determination of:

- The community spouse monthly income allowance (an amount of up to $3,090.00 a month for 2018); and

- A maximum family member allowance for each minor child, dependent child, dependent parent or dependent sibling of either spouse living with the community spouse of $686 for 2018 (if the family member has no income of his/her own).

The community spouse may be able to obtain additional amounts of the institutionalized spouse's income, due to exceptional circumstances resulting in significant financial distress, then would otherwise be allowed under the Medicaid program, by requesting a fair hearing or commencing a family court proceeding against the institutionalized spouse. Significant financial distress means exceptional expenses which the community spouse cannot be expected to meet from the monthly maintenance needs allowance or from amounts held in resources. These expenses may include, but are not limited to: recurring or extraordinary non-covered medical expenses (of the community spouse or dependent family members who live with the community spouse); amounts to preserve, maintain, or make major repairs to the home; and amounts necessary to preserve an income-producing asset. Social Services Law Sections 366-c(2)(g) and 366-c(4)(b) require that the amount of such support orders be deducted from the institutionalized spouse's income for eligibility purposes. Such court orders are only effective back to the filing date of the petition. Please contact your attorney or local Office for the Aging for additional information.

If you wish to request an assessment of the total value of your and your spouse's countable resources, a determination of the community spouse resource allowance, community spouse monthly income allowance, or family member allowance(s) and the method of computing such allowances, please contact your local department of social services. New York City residents should call the Human Resources Administration (HRA) Medicaid Helpline at (888) 692–6116.

Additional Information

For purposes of determining Medicaid eligibility for the institutionalized spouse, a community spouse must cooperate by providing necessary information about his/her resources. Refusal to provide the necessary information shall be reason for denying Medicaid for the institutionalized spouse because Medicaid eligibility cannot be determined. If denial of Medicaid would result in undue hardship for the institutionalized spouse and an assignment of support is executed or the institutionalized spouse is unable to execute such assignment due to physical or mental impairment, Medicaid shall be authorized. However, if the community spouse refuses to make such resource information available, then the Department, at its option, may refer the matter to court.

Undue hardship occurs when:

- A community spouse fails or refuses to cooperate in providing necessary information about his/her resources;

- The institutionalized spouse is otherwise eligible for Medicaid;

- The institutionalized spouse is unable to obtain appropriate medical care without the provision of Medicaid; and

- The community spouse's whereabouts are unknown; or

- The community spouse is incapable of providing the required information due to illness or mental incapacity; or

- The community spouse lived apart from the institutionalized spouse immediately prior to institutionalization; or

- Due to the action or inaction of the community spouse, other than the failure or refusal to cooperate in providing necessary information about his/her resources, the institutionalized spouse will be in need of protection from actual or threatened harm, neglect, or hazardous conditions if discharged from appropriate medical setting.

An institutionalized spouse will not be determined ineligible for Medicaid because the community spouse refuses to make his or her resources in excess of the community spouse resource allowance available to the institutionalized spouse if:

- The institutionalized spouse executes an assignment of support from the community spouse in favor of the social services district; or

- The institutionalized spouse is unable to execute such assignment due to physical or mental impairment.

Contribution from Community Spouse

The amount of money that we will request as a contribution from the community spouse will be based on his/her income and the number of certain individuals in the community depending on that income. We will request a contribution from a community spouse of 25% of the amount his/her otherwise available income that exceeds the minimum monthly maintenance needs allowance plus any family member allowance(s). If the community spouse feels that he/she cannot contribute the amount requested, he/she has the right to schedule a conference with the local department of social services to try to reach an agreement about the amount he/she is able to pay.

Pursuant to Section 366(3)(a) of the Social Services Law, Medicaid MUST be provided to the institutionalized spouse if the community spouse fails or refuses to contribute his/her income towards the institutionalized spouse's cost of care. However, if the community spouse fails or refuses to make his/her income available as requested, then the Department, at its option, may refer the matter to court for a review of the spouse's actual ability to pay.

eMedNY Edit/Error Knowledge Base

Do you need help understanding why a claim pended or denied?

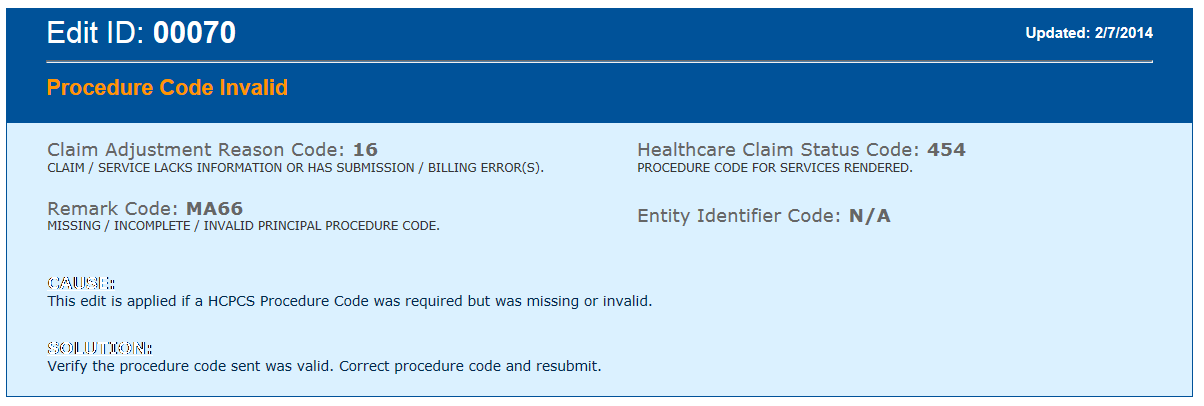

The Edit/Error Knowledge Base (EEKB) is a tool for providers to use in their efforts to analyze the pended and denied claim responses returned on paper or PDF remittance statement, or on the NYSDOH 835 X12 Remittance Advice Transaction, or NYSDOH 277 X12 Claim Status Response. The Edit / Error Knowledge Base returns detailed explanations about specific edits including potential causes and possible solutions to resolve the problem.

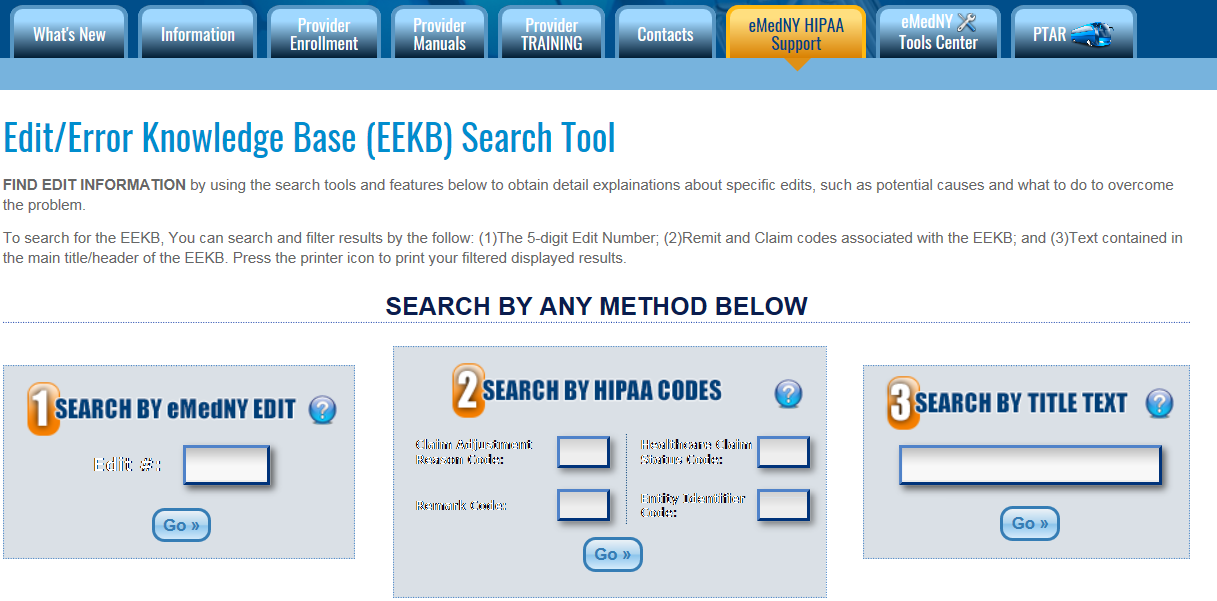

Find Edit/Error Information by using the search tool. The EEKB may be searched three ways. Search using one of the following: (1) the 5-digit Edit Number found on paper and PDF remit; (2) Claim Adjustment Reason Code/Remark Code found in 835 Remit or Healthcare Claim Status Code/Entity Identifier Code found in the 277 claim status response; or (3) Text contained in the main title/header of the EEKB.

Sample Response

For detailed information about the Edit/Error Knowledge Base please go to the eMedNY website at https://www.emedny.org/HIPAA/5010/edit_error/index.aspx.

NY Medicaid EHR Incentive Program Update

The NY Medicaid Electronic Health Records (EHR) Incentive Program provides financial incentives to eligible professionals (EPs) and hospitals to promote the transition to EHRs. Providers who practice using EHRs are in the forefront of improving quality, reducing costs, and addressing health disparities. Since December 2011, more than $900 million in incentive funds have been distributed through 32,546 payments to New York State Medicaid providers.

| Eligible Professionals & Eligible Hospitals Total | |

|---|---|

| Payments Made: | Amount Paid: |

| 32,456 | $900,062,342 |

It is Never Too Early to Begin Preparing for 2017 Meaningful Use

The New York Medicaid EHR Incentive Program has not yet begun accepting 2017 Meaningful Use (MU) attestations in the Medicaid EHR Incentive Program Administrative Support Service (MEIPASS) system. Despite this, it is never too early to begin preparing. Here is a quick check list of items for EPs to complete before attestation time arrives:

- CMS Registration: Prior to attesting, verify your Centers for Medicare & Medicaid Services (CMS) registration information is accurate and up to date. If any information needs to be updated, such as email address or telephone number, correct it in the CMS Registration and Attestation System here: https://ehrincentives.cms.gov/hitech/login.action.

- Fee–For–Service Enrollment: EPs must be registered as fee–for–service Medicaid providers and enrollment must be active throughout the entire attestation, until payment has been processed. For more information visit eMedNY (https://www.emedny.org/) for more information or call eMedNY Provider Services at 1–800–343–9000.

- CEHRT ID: Obtain your EHR Certification ID from the Certified Health IT Product List here: https://chpl.healthit.gov/#/search.

- ETIN Certification: EPs must maintain Electronic/Paper Transmitter Identification Number (ETIN) ETIN certification for Medicaid enrollment and program eligibility. More information is located here: https://www.emedny.org/info/ProviderEnrollment/ProviderMaintForms/490501_ETIN_CERT_Certification_Statement_Cert_Instructions_for_Existing_ETINs.pdf.

- ePACES: The ePACES username and password are used to submit your attestation online through MEIPASS. For assistance with ETIN, ePACES, and MEIPASS: call the support team at 877–646–5410 Option 1 or email meipasshelp@csra.com.

As soon as the MEIPASS system is available for 2017 attestations, an announcement will be posted to the EHR Incentive Program website and a message will go out to all individuals registered to receive the NY Medicaid EHR Incentive Program Listserv. Stay tuned for more information.

NY Medicaid EHR Incentive Program Listserv

The NY Medicaid EHR Incentive Program listserv is a convenient way to have program announcements delivered right to your inbox. The program publishes listserv messages monthly, or more often when important changes to the program impact our participating providers. In the NY Medicaid EHR Incentive Program listserv you can expect to find:

- Current payment totals

- Updates regarding the Medicaid EHR Incentive Program Administrative Support Service (MEIPASS) system

- Attestation dates and deadlines

- Current quarter webinar schedule

- Program requirements

- Links to training resources and tutorials

- CMS final rule releases and programmatic changes

To make sure you never miss out on new program information, register today!

To Register for the NY Medicaid EHR Incentive Program Listserv

Send an email to: listserv@list.ny.gov. In the body of the message, enter: SUBSCRIBE EHR_INCENTIVE-L YOURFIRSTNAME YOURLASTNAME

For example, if your name is John Doe, you would enter: SUBSCRIBE EHR_INCENTIVE-L John Doe

Additionally, those interested in receiving information on the Public Health Reporting Objective for the EHR Incentive Program can register for the MU Public Health Reporting listserv. The MU Public Health Reporting listserv provides information on:

- Medicare and Medicaid updates

- Changes to public health reporting

- Initiatives to the MU Public Health Objective

- Deadline reminders

To Register for the MU Public Health Reporting LISTSERV

Send an email to: listserv@list.ny.gov. In the body of the message, enter: SUBSCRIBE PUBLIC_HEALTH-L YOURFIRSTNAME YOURLASTNAME

For example, if your name is John Doe, you would enter: SUBSCRIBE Public_Health-L John Doe

For more information on the NY Medicaid EHR Incentive Program listserv or the MU Public Health Reporting listserv, visit the EHR Listserv Notifications page here: https://www.health.ny.gov/health_care/medicaid/redesign/ehr/listserv/index.htm.

Contact us at 877-646-5410, option 2 or hit@health.ny.gov. Questions? We have a dedicated support team ready to assist.

Contact us at 877-646-5410, option 2 or hit@health.ny.gov. Questions? We have a dedicated support team ready to assist.

New York State Medicaid Will Begin Covering Voretigene Neparvovec-rzyl (Luxturna™)

New York State (NYS) Medicaid fee-for-service (FFS) and Medicaid Managed Care (MMC) will begin covering voretigene neparvovec-rzyl (brand name Luxturna™) for members who have confirmed biallelic RPE65 mutational-associated retinal dystrophy. This coverage policy is effective April 1, 2018 for FFS and June 1, 2018 for MMC.

NYS Medicaid Coverage Policy:

In accordance with FDA indications, Medicaid reimburses for Luxturna when the following criteria are met:

- The patient must have retinal dystrophy due to confirmed mutations (on genetic testing) in both copies of the RPE65 gene.

- The patient must have viable retinal cells as determined by the treating physician(s).

- The patient must be 12 months of age or older.

- Treatment with Luxturna must be done separately in each eye on separate days, with at least six days between surgical procedures.

- Luxturna must be administered by a surgeon experienced in performing intraocular surgery.

- The patient must not have had treatment with Luxturna previously in the intended eye.

- The facility, at which Luxturna is administered, must be appropriately certified to do so. More information on this can be found here: https://mysparkgeneration.com/hcp-support.html#TreatmentCenters.

Note: The cost of the genetic test used to identify the RPE65 gene is currently being covered by Spark Therapeutics. Please contact Spark Therapeutics for information on how to order the test. Medicaid will not provide reimbursement for this test at this time.

Medicaid Managed Care (MMC) Billing:

Providers participating in MMC should check with the individual health plans to determine how each MMC plan will apply this policy.

Fee-For-Service (FFS) Billing:

- Facilities that are appropriately certified to administer Luxturna will be reimbursed for Luxturna using the ordered ambulatory fee schedule. Payment will be made in addition to the outpatient APG payment or, if administered on an inpatient basis, in addition to the inpatient APR-DRG payment.

- Facilities are to submit a separate ordered ambulatory claim for Luxturna. The ordered ambulatory claim should be submitted on paper (using the eMedNY 150003 claim form) and should include the hospital's actual acquisition cost by invoice. Documentation of medical necessity that includes the criteria listed above must accompany the claim. Ordered ambulatory billing guidelines can be found at: https://www.emedny.org/ProviderManuals/OrderedAmbulatory/PDFS/OrderedAmbulatory_Billing_Guidelines.pdf.

- HCPCS code J3590 (unlisted biologic) should be used to bill for Luxturna until an official HCPCS code is assigned. The associated National Drug Code (NDC) must be included on the claim.

- Providers are reminded that any off-invoice discounts or rebates received from the manufacturer must be passed back to Medicaid. Additionally, consistent with any performance guarantee conveyed by the manufacturer of Luxturna (e.g. drug manufacturer is paid only if the patient responds to therapy), Medicaid should not be billed if no payment has been made by the provider to the manufacturer.

- Storage and handling charges are included in the APR-DRG inpatient payment and the APG outpatient payment and will not be reimbursed separately.

Questions:

- Questions regarding Medicaid FFS billing, please contact eMedNY Provider Services at (800) 343-9000.

- Policy questions regarding Medicaid FFS may be directed to the Office of Health Insurance Programs (OHIP), Division of Program Development and Management at (518) 473-2160.

- Questions regarding MMC reimbursement and/or documentation requirements should be directed to the enrollee's MMC plan.

Medicaid Managed Care Enrollees Service Authorization and Appeals Procedure Changes

The State will implement several changes related to Medicaid managed care service authorization, appeals, fair hearings and grievances (complaints) as required by the Center for Medicare and Medicaid Services (CMS) Medicaid and Children's Health Insurance (CHIP) Programs Final Rule published May 6, 2016, amending federal rules at 42 CFR Part 438. These changes apply to mainstream Medicaid managed care, Health and Recovery Plans (HARPs), HIV Special Needs Plans, Managed Long-Term Care Partial Capitation, Medicaid Advantage, and Medicaid Advantage Plus. These managed care plans are certified under Public Health Law Article 44, and therefore must also continue to comply with the service authorization, appeals and grievance requirements in State statutes. The Department has issued guidance to the health plans for compliance with these changes (including the use of new model enrollee notices) at: https://www.health.ny.gov/health_care/managed_care/plans/index.htm and https://www.health.ny.gov/health_care/medicaid/redesign/mrt90/hlth_plans_prov_prof.htm.

Enrollees will receive notice of these changes on or before April 1, 2018. Health plans will begin handling service authorization requests, appeals and grievances (complaints) under these new rules on May 1, 2018, and thereafter. Starting May 1, 2018, plans will be required to complete review of service authorization requests under different time frames, issue revised enrollee notices, and, for adverse determinations made on May 1, 2018 and thereafter, follow revised appeal processes. Although there are several changes, two key provisions are:

- Starting with plan service determinations made on May 1, 2018 and thereafter, enrollees wishing to dispute a plan's adverse determination regarding their services must exhaust the plan's internal appeal process before requesting a State Fair Hearing. This means the enrollee must request a plan appeal, which may be expedited, and receive a Final Adverse Determination upholding the plan's decision prior to requesting a State Fair Hearing. Enrollees will have 120 days from the Final Adverse Determination to request a State Fair Hearing. If the plan does not respond to the Plan Appeal or the response is late, the appeal process will be deemed exhausted and the enrollee may request a State Fair Hearing.

- Upon review, health plans may determine to reduce, suspend or terminate authorized services. The enrollee will be able to have their aid continue from the plan upon filing a plan appeal within 10 days of the Initial Adverse Determination notice, or before the effective date of the decision, whichever is later. If the plan upholds its decision, and issues a Final Adverse Determination, the enrollee may have their aid continue by requesting a State Fair Hearing within 10 days of the Final Adverse Determination notice, or before the effective date of the decision, whichever is later. If the enrollee loses their plan appeal or Fair Hearing, they may have to pay for the services they received while their appeal/fair hearing was being decided.

Complete information on these appeal processes will be posted on to the Department and health plan websites.

The federal rules changes do not impact the processes for providers to file plan appeals or complaints on their own behalf. However, providers often assist enrollees in filing appeals of plan service denials. Federal regulations now require the enrollee to sign an agreement that they wish the provider to represent them during the appeal and complaint processes prior to the provider filing an appeal or complaint with the health plan on the enrollee's behalf. Providers may still request a reconsideration of a medical necessity denial, otherwise known as "peer-to-peer," if such decision was made by the plan without prior consultation with the provider. The federal rules also limit enrollees to only one level of internal appeal for plan adverse benefit determinations. Otherwise, Independent External Appeal processes for disputing medical necessity decisions as provided by Public Health Law Article 49 remain unchanged.

Please contact 438reg@health.ny.gov if you have any questions regarding these regulation changes. Questions regarding a health plan's authorization, appeals or complaint procedures should be directed to the health plan.

Medicaid Breast Cancer Surgery Centers

Research shows that five-year survival increases for women who have their breast cancer surgery performed at high-volume facilities and by high-volume surgeons. Therefore, it is the policy of the New York State Department of Health that Medicaid recipients receive mastectomy and lumpectomy procedures associated with a breast cancer diagnosis at high-volume facilities defined as averaging 30 or more all-payer surgeries annually over a three-year period. Low-volume facilities will not be reimbursed for breast cancer surgeries provided to Medicaid recipients. This policy is part of an ongoing effort to reform New York State Medicaid and to ensure the purchase of cost-effective, high-quality health care and better outcomes for its recipients.

The Department has completed its tenth annual review of all-payer breast cancer surgical volumes for 2014 through 2016 using the Statewide Planning and Research Cooperative System (SPARCS) database. Seventy-six low-volume hospitals and ambulatory surgery centers throughout New York State were identified. These facilities have been notified of the restriction effective April 1, 2018. The policy does not restrict a facility's ability to provide diagnostic or excisional biopsies and post-surgical care (chemotherapy, radiation, reconstruction, etc.) for Medicaid patients. Other facilities in the same region as the restricted facilities have met or exceeded the volume threshold and Medicaid patients who require breast cancer surgery should be directed to those providers.

The Department will annually re-examine all-payer SPARCS surgical volumes to revise the list of low-volume hospitals and ambulatory surgery centers. The annual review will also allow previously restricted providers meeting the minimum three-year average all-payer volume threshold to provide breast cancer surgery services for Medicaid recipients.

For more information and the list of restricted low-volume facilities, please see: http://www.health.ny.gov/health_care/medicaid/quality/surgery/cancer/breast/. If you have any questions, please contact the Department at (518) 486–9012.

Coverage of Preferred Diabetic Test Strips and Lancets

Effective April 19, 2018 the NYS fee-for-service (FFS) Medicaid pharmacy program will implement additional clinical editing on diabetic test strips. This editing will compare the number of test strip to the number of lancets on hand over time. Test strip claims will deny and require prescriber involvement if the number of test strips to lancets exceeds a reasonable ratio.

This is in addition to the clinical editing applied to diabetic test strips implemented on July 20, 2017 limiting quantities to:

- Diabetes Type I: Maximum of 300 test strips dispensed as a 30-day supply

- Diabetes Type II: Maximum of 100 test strips dispensed as a 30-day supply

More information on this can be found here: https://www.health.ny.gov/health_care/medicaid/program/update/2017/2017-07.htm#priorauth.

Note: Claims that meet the above clinical criteria will approve systematically and will not require prescriber involvement.

The most up-to-date information on the Medicaid FFS Pharmacy Prior Authorization (PA) Programs and a full listing of drugs/supplies subject to the Medicaid FFS Pharmacy Programs can be found at: https://newyork.fhsc.com/downloads/providers/NYRx_PDP_PDL.pdf.

To obtain a PA, please contact the clinical call center at 1-877-309-9493. The clinical call center is available 24 hours a day, 7 days a week with pharmacy technicians and pharmacists who will work with you, or your agent, to quickly obtain a PA. Medicaid enrolled prescribers can also initiate PA requests using the web-based application PAXpress®. PAXpress® is a pharmacy PA request/response application accessible through a new "PAXpress" button located on www.eMedNY.org.

Additional information, such as the Medicaid Standardized PA form and clinical criteria, are available at the following websites: http://www.health.ny.gov,http://newyork.fhsc.com, or http://www.eMedNY.org.

For more detailed information on the Preferred Diabetic Supply Program, please refer to: https://newyork.fhsc.com/providers/diabeticsupplies.asp.

Review of the CDC Guideline for Prescribing Opioids in Patients with Chronic Pain

The CDC Guideline for Prescribing Opioids in Patients with Chronic Pain – United States, 2016, is intended to provide recommendations to primary care providers on safe opioid prescribing practices.1 It is noted that primary care providers are accountable for about 50 percent of opioid prescriptions.2 The Centers for Disease Control and Prevention (CDC) stresses the importance of open communication and provider-to-patient education on the risks and benefits of opioid use for the treatment of pain.1

The CDC, as well as various pain management guidelines, all agree that non-pharmacologic and non-opioid pharmacologic treatments should be considered before initiating opioid therapy for pain management. Patients should also be assessed for risks versus benefits of opioid treatment before initiating opioids. During treatment, pain and functionality should be assessed in comparison to baseline.1 Some highlights from the CDC recommendations on initial prescribing of opioids1 include:

- Initiate opioid treatment with the lowest effective dose of an immediate release product.

- Evaluate pain therapy initially, after 1-4 weeks; then, at least every 3 months.

- Avoid increasing dose to = 90 MME /day total (= 90 mg hydrocodone; = 60 mg oxycodone),

or carefully justify; consider specialist referral. (This does not pertain to patients who are already on an opioid dose > 90 MME.) - Set treatment goals e.g. 30% improvement on PEG (Pain, Enjoyment, General activity) test, return to work, etc.

- Evaluate risk factors for opioid-related overdose or opioid use disorder e.g. mental health disorders (depression, anxiety), history of overdose, concurrent benzodiazepine use, higher opioid dosages (=50 MME/day).

- Consult the prescription drug monitoring program (PMP) data to review patients' history of controlled substance prescriptions to evaluate dosages and potentially dangerous combinations. More information can be found here: http://www.health.ny.gov/professionals/narcotic/prescription_monitoring/.

Safe and effective pharmacotherapy depends on the assessment of the patient's entire clinical profile.

1. Dowell D, Haegerich TM, Chou R. CDC guideline for prescribing opioids for chronic pain - United States, 2016. MMWR Recomm Rep. 2016;65(1):1-49. http://www.cdc.gov/mmwr/volumes/65/rr/pdfs/rr6501e1.pdf

2. Centers for Disease Control and Prevention (CDC). Why guidelines for primary care providers? http://www.cdc.gov/drugoverdose/pdf/guideline_infographic-a.pdf.

CDC. Guidelines for Prescribing Opioids for Chronic Pain. https://www.cdc.gov/drugoverdose/pdf/guidelines_factsheet-a.pdf

CDC. Nonopioid treatments for chronic pain. https://www.cdc.gov/drugoverdose/pdf/nonopioid_treatments-a.pdf

CDC. Checklist for prescribing opioids for chronic pain. https://stacks.cdc.gov/view/cdc/38025

Pharmacy Providers: Auto Refill Policy

Reminder

Automatic refill programs offered by pharmacies are not an option for Medicaid members. Automatic refilling of prescriptions/orders for prescription drugs, over-the-counter products, medical surgical supplies, and enteral products are not allowed under New York State Medicaid. This policy does not preclude other adherence programs. All laws, regulations and policies must be followed.

The following Refill Requests are allowed:

- Requests for a refill by a Medicaid member or designated caregiver who initiates the request for a refill to the pharmacy.

- Provider directly initiates refill by contacting a Medicaid member to determine if a refill is necessary, by phone, or electronic means (e.g., text message). Documentation of the need for each refill shall be maintained in the patient record. The documentation must include the date and time of member contact, the Medicaid member's or designated caregiver's name with response, and the name of the pharmacy staff member who contacted the member or caregiver (if by phone), or electronic method. The documentation must be available for audit purposes. Compliance with HIPAA privacy guidelines is mandatory.

Questions? Please contact the Medicaid Pharmacy Policy and Operations staff at (518) 486–3209.

The Medicaid Update is a monthly publication of the New York State Department of Health.

Andrew M. Cuomo

Governor

State of New York

Howard A. Zucker, M.D., J.D.

Commissioner

New York State Department of Health

Jason A. Helgerson

Medicaid Director

Office of Health Insurance Programs